If you are an investor that lives outside the United States there are certain requirements that must be met with the Internal Revenue Service (IRS), the US taxing authority.

All these requirements must be met before we can release any money due to you. This is the law and we cannot break it. So please don’t ask us to the answer will be an apologetic no.

It is very easy to become compliant, but if you need help we have links to the names and numbers of Certified Public Accountants that specialize in working with investors outside of the US.

National ERA Servicing, LLC will retain and keep 30% of all gross rents collected on every property owner that lacks tax compliance at the end of every tax year.

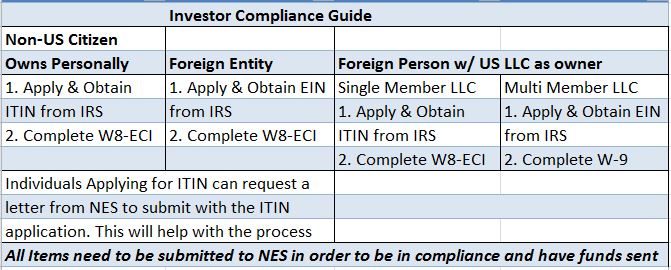

This simple chart and downloadable forms will help you determine what you need to do to be IRS compliant and to be able to receive your money on a regular basis.

Forms are available here:

You can get more IRS information here: Internal Revenue Service

To have someone do it for you click the link below

AGH Certified Public Accountants

We are not Certified Public Accountants and cannot give financial advise. Please call a Professional for these matters.